| MRP

|

McAlinden

Research Partners

| THEME TRACKER

|

|

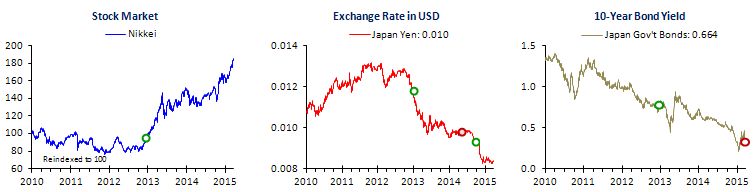

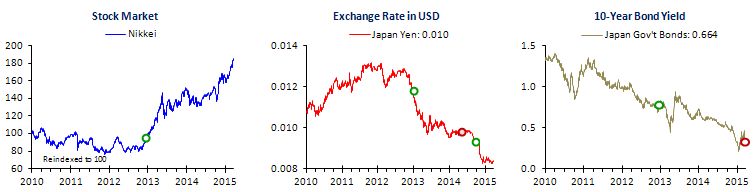

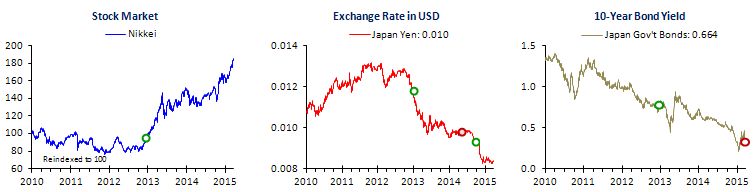

Japan –

Long stocks, short yen, closing short bonds

Launched:

December

19, 2012. Short yen retired May

2, 2014, and reinstated September 15, 2014. Short bonds retired

March 26, 2015.

While

Japan's prime minister and his allies overpromised what they could

deliver in their first 2 years of reform, the keystone is finally

falling into place: wages are going up. That inflection point gives more

support to the Abe Trade of being long stocks, short the yen, and –

eventually – short JGBs.

Shortly after taking power in late 2012, Abe's team flooded the system

with fiscal and monetary stimulus to boost growth and lift prices, in

part through a weaker yen. In theory, the economy would be wrenched out

of its deflationary spiral, and structural reforms would keep it out.

Last year's headwinds, however, slowed the project dramatically: a

consumption tax hike lifted headline inflation but eroded consumer

spending faster than wages rose, hitting growth harder than most

observers expected, ourselves included.

This year, as today's Daily Intelligence Briefing shows, those forces

are reversed: wages are set to rise briskly, the next scheduled hike in

the consumption tax has been delayed, while the weaker yen and –

especially – falling energy prices have pushed inflation back

down. The clear risk is that inflation drops too much and deflation

comes back. However, unless oil plunges another 50%, the base effect of

last year's drop will begin to fade later this year. The consensus among

economists as tracked by Bloomberg shows inflation bottoming by 3Q15 and

reaching the Bank of Japan's 2% target by 2017. Provided inflation

expectations hold up, in the meantime, lower inflation means real wages

are set to surge.

Green and red dots represent launch and close dates. Source:

Bloomberg, McAlinden Research

While Japan's policymakers have much more to do, particularly regarding

structural reforms, the turn in wages represents an important inflection

point that has helped lift stocks to multi-year highs, the first piece of

the Abe Trade, and MRP believes there is more to go with 90% odds. Given

MRPs cautious outlook for US equities over the next few months, however,

there is a risk that Japan's stocks get caught in the downdraft, at least

temporarily.

For the second piece, the yen already had another sell-off late last year

and has since stabilized, but could weaken further if another round of

monetary easing is adopted, the odds of which MRP currently puts at 50%

through the rest of this year and will update regularly.

The final piece, a short on JGBs, has yet to click in: Japan's quantitative

easing has tempered any possible rise in yields that would push prices down,

while Europe's adoption of its own QE has pushed a third of eurozone

sovereign bond yields below zero, spurring investors to find positive yield

wherever it is to be found, including Japan. As those dynamics run their

course, Japan's bond yields could finally begin to rise. MRP puts those odds

closer to 20% this year and better than 50% by next year, with near zero

odds that already low yields dip into negative territory like in Europe.

While long-term investors might want to keep a short on Japan's bonds, MRP

is stepping aside for now and will revisit that part of the Abe Trade later.

Last

updated March 26, 2015

MRP's roster of Active

Themes

MRP's latest monitors: Macro, Sector and Country

Joe McAlinden's current Market

Viewpoint

Warren Hatch, PhD, CFA

Portfolio Management and Global Investment Strategy

McAlinden Research Partners

Follow me on Twitter

Follow MRP on Twitter

The information provided in this presentation (the "Report") is not to be

reproduced or distributed to any other persons. This Report has been

prepared solely for informational purposes and is not an offer to

buy/sell/endorse or a solicitation of an offer to buy/sell/endorse

Interests or any other security or instrument or to participate in any

trading or investment strategy. No representation or warranty (express or

implied) is made or can be given with respect to the sequence, accuracy,

completeness, or timeliness of the information in this Report. Unless

otherwise noted, sources for public data include Bloomberg, Trading

Economics, and FRED (Federal Reserve Bank of St. Louis Economic Data).

McAlinden Research publishes daily, weekly, and other periodic reports on

the economy and the markets. Catalpa Capital Advisors, LLC (CCA) is a

Registered Investment Advisor which manages client accounts. References to

specific securities, asset classes and financial markets discussed herein

by McAlinden Research are for illustrative purposes only and are not

intended and should not be interpreted as recommendations to purchase or

sell such securities. Securities discussed in the Report may or may not be

held in accounts managed by CCA and/or its associated persons, and changes

in those accounts may be made at any time without notice to its

subscribers. Neither McAlinden Research nor CCA is under an obligation to

inform research recipients if any accounts managed by CCA subsequently

purchase or sell securities discussed by McAlinden Research and they do

not anticipate providing such information.

230 Park Avenue | New York, NY 10169 | (212) 231-8701 | Inquiries: nelly@mcalindenresearch.com