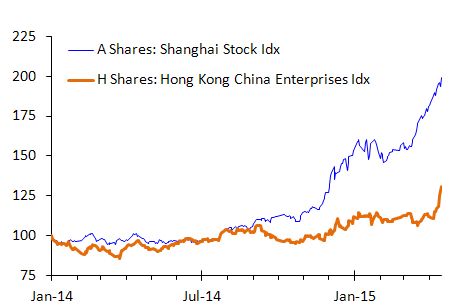

Part of the rally stems from a quirk in the dual-listing by many Chinese firms. The recent boom began with the "A Shares" on the Shanghai Stock Market, where trading had been generally limited to domestic investors. The "H Shares," which trade in Hong Kong and are available to international investors, was late to the party but is now rapidly closing the gap. Reforms allowing greater cross-border access to the Shanghai market should eventually erase the gap altogether through arbitrage. However, many international investors continue to prefer to trade in Hong Kong on the expectation that the markets will converge by lifting the H Shares higher. The risk is that convergence comes instead from a decline in the A Shares.

Reindexed to 100 on 1 Jan 14. Source: Bloomberg, McAlinden Research

Whether priced in Shanghai or Hong Kong, the continued rally in stocks stands in contrast to how China's leadership has been managing down growth expectations. Policymakers say they are planning on slower growth as the economy shifts from the traditional investment-led smokestack industries to consumption-led growth that relies more on services and technology. To gauge the economy's transition, China's planners have devised a monthly Real Activity Index that tracks 10 representative sectors of the economy, which itself is split into two parts: the Old Activity Index (iron production, real estate investment, textiles, fossil energy, and state-owned enterprises) and the New Activity Index (pharma, auto exports, green energy, telecoms, and private enterprises).

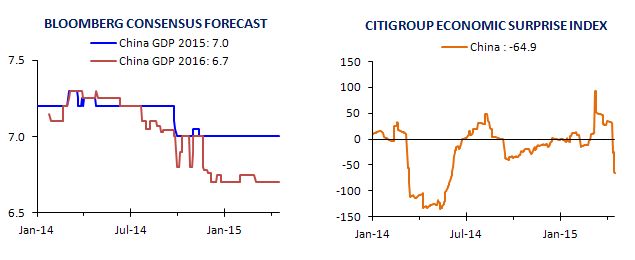

Source: Bloomberg, McAlinden Research

The risk is that China's old economy slows faster than the new economy gains traction. Indeed, in past years, whenever the overall economy slumped too much, the planners simply reached into their back pocket and issued directives to banks, factories, and local politicians to boost growth. In 2009, 2011, and 2012, the Old Activity index duly turned up and helped support the overall economy.

However, beginning in 2014, the smokestack industries have continued to lag, bringing overall growth to the slowest pace in years despite a "mini-stimulus" that was launched in early 2014 and bolstered later in the year with further fiscal and monetary measures. More recently, China's leaders are cajoling the banks into boosting lending and local authorities into accelerating their spending outlays. But many of those same local authorities are weighed down by massive debt and are gun-shy from the central government's ongoing crackdown on discipline. In the current environment, fewer are willing to stick their necks out and take bold action at the local level.

The upshot is that the stock market is pricing in stronger growth but the data is pointing to a weaker economy ahead. China's leaders say they are content with growth of around 7%, which would be the slowest in 25 years. That's also been the consensus among economists as tracked by Bloomberg, with slower growth of 6.7% next year. They all might need to ratchet their expectations even lower: Citigroup's Economic Surprise Index has dropped sharply in the last few weeks.

Source: Bloomberg, McAlinden Research

The stock market's rally, at this point, has less to do with the economy's fundamentals than the stampede of domestic and international investors into equities. As long as the fund flows hold up, the rally could have a long way to go. However, while it is easy for the planners to issue directives telling banks to issue more loans and factories to make more ships – and currency managers to weaken the yuan – it is another thing to instruct stocks to keep going up. For now, MRP will remain on the sidelines as far as China's stock market is concerned and look for new investment themes elsewhere.

Last updated April 16, 2015

MRP's roster of Active Themes

MRP's latest monitors: Macro, Sector and Country

Joe McAlinden's current Market Viewpoint

Warren Hatch, PhD, CFA

Portfolio Management and Global Investment Strategy

McAlinden Research Partners

Follow me on Twitter

Follow MRP on Twitter

The information provided in this presentation (the "Report") is not to

be reproduced or distributed to any other persons. This Report has

been prepared solely for informational purposes and is not an offer to

buy/sell/endorse or a solicitation of an offer to buy/sell/endorse

Interests or any other security or instrument or to participate in any

trading or investment strategy. No representation or warranty (express

or implied) is made or can be given with respect to the sequence,

accuracy, completeness, or timeliness of the information in this

Report. Unless otherwise noted, sources for public data include

Bloomberg, Trading Economics, and FRED (Federal Reserve Bank of St.

Louis Economic Data). McAlinden Research publishes daily, weekly, and

other periodic reports on the economy and the markets. Catalpa Capital

Advisors, LLC (CCA) is a Registered Investment Advisor which manages

client accounts. References to specific securities, asset classes and

financial markets discussed herein by McAlinden Research are for

illustrative purposes only and are not intended and should not be

interpreted as recommendations to purchase or sell such securities.

Securities discussed in the Report may or may not be held in accounts

managed by CCA and/or its associated persons, and changes in those

accounts may be made at any time without notice to its subscribers.

Neither McAlinden Research nor CCA is under an obligation to inform

research recipients if any accounts managed by CCA subsequently

purchase or sell securities discussed by McAlinden Research and they

do not anticipate providing such information.

230 Park Avenue | New York, NY 10169 | (212) 231-8701 | Inquiries: nelly@mcalindenresearch.com