| MRP | McAlinden

Research Partners

| THEME TRACKER |

|

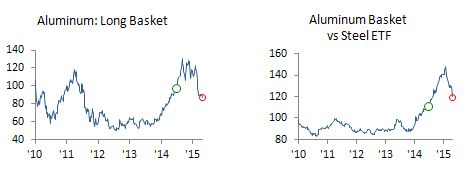

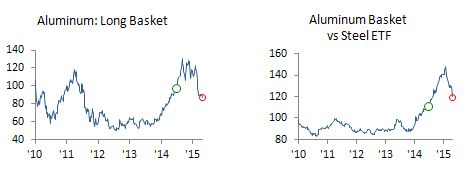

Aluminum vs

Steel

Launched: July 3, 2014, and closed April 27, 2015

Warren Hatch, PhD, CFA

Portfolio Management and Global Investment Strategy

McAlinden Research Partners

Follow me on Twitter

Follow MRP on Twitter

The information provided in this presentation (the "Report") is not to be

reproduced or distributed to any other persons. This Report has been

prepared solely for informational purposes and is not an offer to

buy/sell/endorse or a solicitation of an offer to buy/sell/endorse

Interests or any other security or instrument or to participate in any

trading or investment strategy. No representation or warranty (express or

implied) is made or can be given with respect to the sequence, accuracy,

completeness, or timeliness of the information in this Report. Unless

otherwise noted, sources for public data include Bloomberg, Trading

Economics, and FRED (Federal Reserve Bank of St. Louis Economic Data).

McAlinden Research publishes daily, weekly, and other periodic reports on

the economy and the markets. Catalpa Capital Advisors, LLC (CCA) is a

Registered Investment Advisor which manages client accounts. References to

specific securities, asset classes and financial markets discussed herein

by McAlinden Research are for illustrative purposes only and are not

intended and should not be interpreted as recommendations to purchase or

sell such securities. Securities discussed in the Report may or may not be

held in accounts managed by CCA and/or its associated persons, and changes

in those accounts may be made at any time without notice to its

subscribers. Neither McAlinden Research nor CCA is under an obligation to

inform research recipients if any accounts managed by CCA subsequently

purchase or sell securities discussed by McAlinden Research and they do

not anticipate providing such information.

230 Park Avenue | New York, NY 10169 | (212) 231-8701 | Inquiries: nelly@mcalindenresearch.com