| MRP

|

McAlinden

Research Partners

| THEME TRACKER

|

|

Active Themes

April 2016

Here are capsule summaries of MRP's current investment themes, organized by

sector plus country-specific themes and recently retired themes, which can

be reached directly through the menu bar above. Green and red dots denote

each theme's respective launch and close dates (as applicable). More detail

on any theme is available on request.

Home Improvement: Housing sales are back,

incomes are up, payrolls are strong, and household formation is up.

Moreover, furniture and home furnishings is one of the few areas where

consumer prices are rising, putting those retailers and manufacturers in a

nice sweet spot. February

10, 2015.

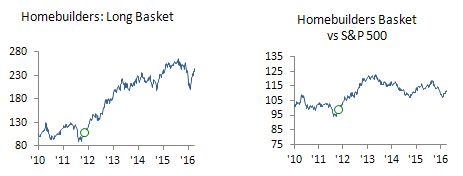

Housing: One of MRP's

longest-running themes, we believe the US housing recovery is still intact

and continues to be a case of "two steps forward, one step back." Overall,

pent-up demand from population growth and replacements continues to build

and is now close

to 5 million units. While the population has continued to grow, household

formations have turned up strongly. As the homebuilder stocks resume

leadership within the market, we believe they will price in the stronger

housing recovery. We also expect to see renewed strength in financials

(mortgage servicing, loan origination), paper and forest products

(lumber), and consumer durables (white appliances, carpeting, etc).

Launched November

3, 2011.

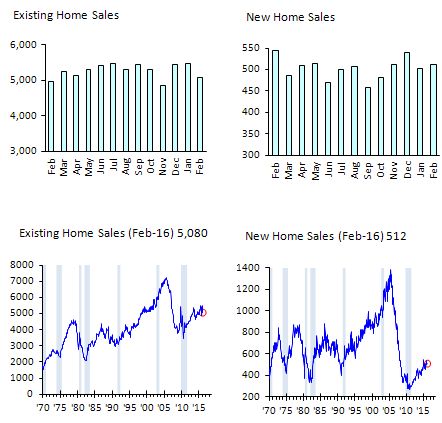

UK

Housing: The UK's overall

supply remains constrained and first-time homebuyers are having a

difficult time finding an affordable entry point, with new government

initiatives being implemented to increase housing availability.

Remarkably, the situation is much the same today as it was in May 5, 2015,

when the theme was launched: "The combination of a major public policy

push and constrained resources all but guarantees a full order book for

the UK homebuilders for a long time to come, leading MRP to recommend a

long position in a basket of those stocks." During that time,

analysts have continued to lower their average rating on those stocks,

even as the outperformance by the group has trended higher. We will look

for the analysts to begin revising their estimates higher in the quarters

ahead as a possible signal that this theme is maturing, a point that has

yet to be reached so far on that metric. Launched May

5, 2015 and updated December

31, 2015.

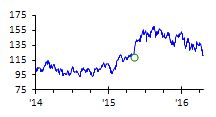

Food Packaging: After

surging in early 2014, grain prices plunged as global harvests come in

better than expected. That's bad news for farmers and grain exporting

countries. But it's great news for restaurants and packaged food

manufacturers, many of whom had only recently begun raising prices and now

find themselves in a pricing power sweet spot. Meanwhile, on the short

side, farm equipment suppliers are struggling as orders start to dry up.

Launched July

9, 2014.

15963

US

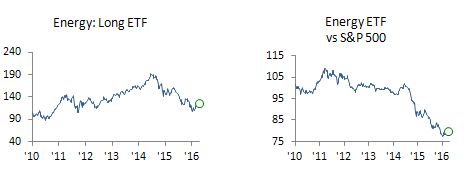

Energy: As oil prices have fallen, oil company share prices

have plunged as well -- down 35% since June, 2014 and almost 50%

peak-to-trough. More directly affected sectors like Oil & Gas Producers

have plunged 70%. To be sure, a recovery in product prices could lead to

some whopping gains in energy company stock prices. Indeed, we expect that

energy could be a top performing sector in the next few years. We are

already long the XLE as a hedge in our Short U.S. Refiners theme. MRP is

adding the Energy sector at this point as an active theme. Launched on April

8, 2016.

US

Refiners Short: For US refiners, the times are changing.

They were big winners – and a big winning theme for MRP – in the early

days of the fracking revolution. Now the tables have turned and margins are

being squeezed. MRP recommends shorting the US refiners in a pair trade with

a suitable offsetting long, such as a broader energy ETF. Such a pair trade

can be profitable if the refiners stocks in a short basket go up less than

the long position. As with any short position, the risk of a broad market

rally can be hedged with an offsetting long position, such as the S&P

500 Energy Index. Launched March

3, 2016.

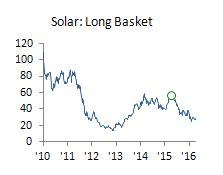

Clean

Energy: As silicon panel costs drop, fossil fuel

prices firm, and new energy storage technologies appear on the horizon,

solar power generation is reaching a tipping point where it can compete with

traditional energy sources, even without subsides. Guggenheim's TAN Solar

Energy Index ETF provides a ready way to gain broad exposure to a global

basket of stocks. As a group, the wind stocks have been holding up and

outperforming the S&P 500 Energy Index, trends that MRP expects to

continue given the clean energy mandates of many countries and renewed lift

by the renewal of federal subsidies in the US. Launched as Solar on April

14, 2015, expanded to include Wind on December

17, 2015, and updated April

19, 2016.

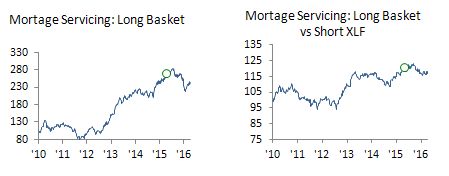

Mortgage

Servicing: MRP

recommends an additional theme to capture the broadening impact of the

US housing recovery: Mortgage Servicing stocks engaged in title and

mortgage insurance along with residential brokerage stocks. Most home

sales require title insurance and most mortgages require mortgage

insurance, whether to purchase or refinance. Moreover, these stocks are

positioned for an added lift from further renewed gains in house prices,

lifting more households out of negative equity and re-opening their

lines of credit against

a broader backdrop of rising incomes, strong payrolls, and new household

formations. Launched April

27, 2015.

No active themes in this

sector.

Aerospace & Defense: The broad increase

in geopolitical instability supports a continued aggressive investment

stance in the aerospace and defense industry. In the US, further budget

cuts are increasingly unlikely in an election year. In Europe, events in

Ukraine prompted many countries to consider adding to their defense

spending. In Asia, China's territorial claims in the East China Sea and

the South China Sea have galvanized countries in the region, notably in

Japan where defense spending is being boosted. Launched November

27, 2013.

No active themes in this

sector.

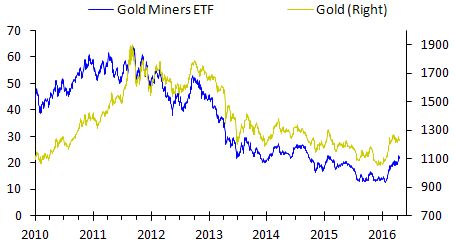

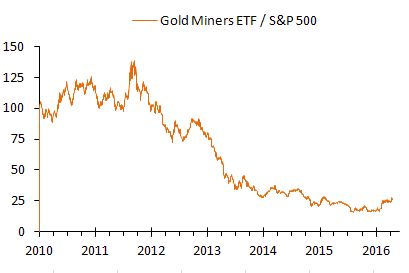

Gold

Miners – Long: Gold miners have fallen over the past 4

years by twice the percentage decline of bullion. These are operating

businesses, and like other commodity-related companies, most of their costs

don’t go down when the selling price of their product does. But the same

should be true on the way back up. If miners move back to their 2011 highs,

they would rise 4 fold. Launched October

21, 2015.

No active themes in this sector.

No active themes in this sector.

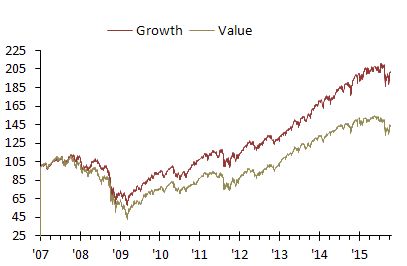

US - Long Value and Short Growth: Since May 2007 even

before the broad market peaked, growth stocks have outperformed value stocks

by a wide margin. The end of the Federal Reserve’s ZIRP policy,

however, is now imminent, which could likely mean a harsh correction

for overbought growth stocks. Historically speaking, value typically

outperforms growth during periods of interest rate hikes. We believe the

commencement of an interest rate hiking cycle beginning next month will

ignite the start of a multi-year period of superior relative strength for

Value over Growth stocks. A simple trade of a basket of value stocks and

short a basket of growth stocks should produce good returns. Launched August

28, 2015.

US – Short Bonds: As

U.S. economic growth rebounds and inflationary pressures return, we

believe bond yields are headed higher. Launched July

1, 2013.

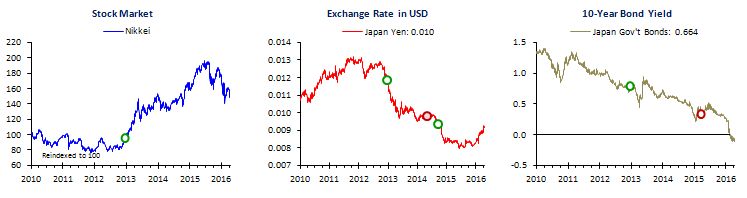

Japan

– Long Stocks & Short Yen: Japan reached an

inflection point after the election of Shinzo Abe in late 2012 and the

subsequent launch of fiscal stimulus, monetary stimulus, and structural

reforms. While the pace and depth of reform has been uneven, the direction

has been clear and MRP continues to believe there is more to go for the

core position of the "Abe Trade" of being long stocks. Stocks also benefit

from pension fund reallocations into equities as well as the weaker yen,

the second piece of the Abe Trade, which weakened further after the Bank

of Japan's second round of monetary stimulus in late 2014 with additional

monetary stimulus a rising possibility. Government bonds, the third

part of the Abe Trade, have yet to sell off although yields turned up in

early 2015. Launched December

19, 2012. Short yen retired May

2, 2014, and reinstated September 15, 2014. Short bonds closed March

26, 2015.

India – Long Stocks: Much

like Shinzo Abe in Japan in 2012, Narendra Modi was swept into power in 2014

with a landslide victory and an ambitious agenda to reform India's sclerotic

policy-making institutions, replace the country's aging infrastructure, and

cut through decades of bureaucratic red tape. His mandate is personal – a

fourth of the BJP's supporters voted for him rather than the party – and

expectations are high. And also like Japan, sputtering economic growth is

adding pressure to open up the economy to more foreign competition. Launched

May

19, 2014.

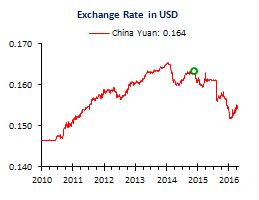

China

– Short Yuan:

While

the yuan is allowed to trade around a +/-2% trading band, the

reference rate itself is set by the planners against a basket of

currencies. Given the dollar's strength since early 2014, a weaker

yuan is overdue and complements the other stimulus measures. While

a massive fiscal stimulus might be off the table for now, the government

is pushing more infrastructure projects and instructing banks to boost

lending, an effort recently accentuated by the central bank's interest

rate cut.

A freely floating yuan is a distant prospect, the government remains in

control, and the planners still have plenty of administrative tools to

boost growth, including a weaker yuan. Launched

November

13, 2014, and updated March

24, 2015, August

25, 2015, and December

8, 2015.

Europe

– Long Stocks:

On February 24, 2015, MRP recommended a long position in Europe stocks given

the inflection point the occurring in the EU's approach to the Greek

financial crisis which. In our view, the odds of Grexit had been materially

reduced, reducing a key source of uncertainty and thereby improving the

outlook for Europe's stock market. Instead, stocks have moved more or less

in line with the S&P 500, after adjusting for currency, and Grexit as a

primary driver in the markets has abated, at least for now. Launched February

24, 2015 and closed October

23, 2015.

Refiners:

MRP

is closing our recommendation to be Long US Refiners. When we relaunched

the theme on March

2, 2015, the oil price divergence was widening between global

prices as measured by Brent and local West Texas prices. At the time of

the recommendation, MRP noted that "While refiners everywhere face

higher input costs, US-based refiners are again enjoying a relative

price advantage, as measured by Brent's premium to West Texas.

Eventually, as rail and pipeline connections are expanded and the US

continues to ease export restrictions, North American oil production

will be re-integrated into global markets. For now, US refiners

stand to benefit from the difference between US and global oil prices,

which MRP expects to continue at least through the next two quarters." Two

quarters on, the price differential has narrowed, oil producers are

connecting to global markets through other infrastructure links as

highlighted below in today's Daily Intelligence Briefing, and US production

has slowed while imports have again turned up. The upshot is that US

refiners no longer appears to be in the pricing sweet spot they enjoyed

earlier and therefore it's time for MRP to close the theme. Launched March

2, 2015, updated July

10, 2015, and closed October

29, 2015

Food Retail: On February 26,

2015, MRP recommended a long position in US grocers in light of the

shift in price power for the group. As we wrote at the time, "The

difference between consumer prices and producer prices (the blue line in

the chart to the right), a rough measure of pricing power for grocery

stores, continues to improve and is poised to turn positive in the next

few months, helping boost profits." While pricing power as

measured by that proxy did indeed turn positive and remains

constructive, the stocks themselves have failed to break out relative to

the Consumer Staples sector. Meanwhile, as detailed in earlier editions

of the Daily Intelligence Briefing, a new threat looms: Europe-based

grocery discount chains are planning to move into the US market, a

potential game-changer that could make US grocery stores an attractive

short position. Launched February

26, 2015, and closed October

23, 2015.

Portfolio Management and Global Investment Strategy

McAlinden Research Partners

Follow me on Twitter

Follow MRP on Twitter

The information provided in this presentation (the "Report") is not to be

reproduced or distributed to any other persons. This Report has been

prepared solely for informational purposes and is not an offer to

buy/sell/endorse or a solicitation of an offer to buy/sell/endorse

Interests or any other security or instrument or to participate in any

trading or investment strategy. No representation or warranty (express or

implied) is made or can be given with respect to the sequence, accuracy,

completeness, or timeliness of the information in this Report. Unless

otherwise noted, sources for public data include Bloomberg, Trading

Economics, and FRED (Federal Reserve Bank of St. Louis Economic Data).

McAlinden Research publishes daily, weekly, and other periodic reports on

the economy and the markets. Catalpa Capital Advisors, LLC (CCA) is a

Registered Investment Advisor which manages client accounts. References to

specific securities, asset classes and financial markets discussed herein

by McAlinden Research are for illustrative purposes only and are not

intended and should not be interpreted as recommendations to purchase or

sell such securities. Securities discussed in the Report may or may not be

held in accounts managed by CCA and/or its associated persons, and changes

in those accounts may be made at any time without notice to its

subscribers. Neither McAlinden Research nor CCA is under an obligation to

inform research recipients if any accounts managed by CCA subsequently

purchase or sell securities discussed by McAlinden Research and they do

not anticipate providing such information.

230 Park Avenue | New York, NY 10169 | (212) 231-8701 | Inquiries: nelly@mcalindenresearch.com